Africa represents one of the world’s most dynamic and rapidly evolving business landscapes. With a population exceeding 1.4 billion people and a collective GDP surpassing $3 trillion, the continent offers unprecedented opportunities for businesses seeking expansion beyond traditional markets. However, successfully navigating African markets requires more than ambition—it demands strategic market analysis services tailored to the unique complexities of the region.

For businesses targeting African expansion, Nigeria stands as the strategic gateway. As Africa’s largest economy and most populous nation, Nigeria provides the market intelligence, infrastructure, and consumer insights that form the foundation for broader continental success. This comprehensive guide explores how professional market analysis service Nigeria and market research Africa solutions can transform your expansion strategy from concept to reality.

Why Nigeria is the Gateway to African Market Expansion

Nigeria’s position as Africa’s premier market entry point is undisputed. With over 220 million people, Nigeria accounts for approximately 16% of Africa’s total population and represents the continent’s largest consumer market. The country’s nominal GDP of over $477 billion makes it the largest economy in Africa, creating a business environment where market trends often forecast broader African developments.

The Nigerian market offers unique advantages for businesses planning African expansion. First, the country’s diverse ethnic composition and linguistic variety mirror the complexity found across the continent, making Nigeria an ideal testing ground for products and services. Success in Nigeria often translates to adaptability across multiple African markets. Second, Nigeria’s digital infrastructure and mobile penetration rates rank among Africa’s highest, enabling sophisticated market research methodologies and consumer engagement strategies.

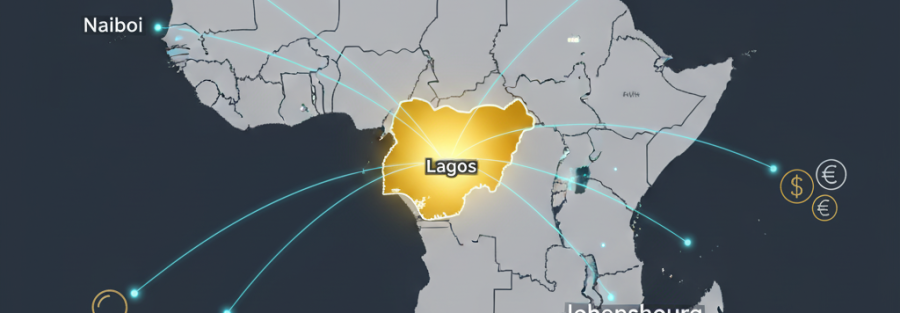

Lagos alone, Nigeria’s commercial capital, boasts a GDP larger than several African countries combined. This megacity serves as a continental business hub where international companies establish regional headquarters, creating an ecosystem of business services, talent, and market intelligence. For companies seeking market analysis service Nigeria, Lagos provides unparalleled access to data, expertise, and on-ground insights essential for informed decision-making.

The country’s economic diversification efforts have created opportunities across multiple sectors, from agriculture and manufacturing to technology and financial services. This sector diversity allows businesses to test various market entry strategies while leveraging Nigeria’s position within regional economic blocs like ECOWAS (Economic Community of West African States), which facilitates trade across 15 West African nations.

Understanding Market Analysis Services for African Growth

Market analysis services encompass a comprehensive range of research activities designed to provide businesses with actionable intelligence about target markets. In the African context, these services go beyond traditional market research to address the unique challenges and opportunities presented by emerging economies, rapidly evolving consumer behaviors, and dynamic regulatory environments.

A professional market analysis service Nigeria typically begins with market sizing and segmentation. This involves quantifying the total addressable market, identifying specific customer segments, and evaluating growth trajectories across different timeframes. Unlike developed markets where such data is readily available, African markets often require primary research methodologies, including field surveys, focus groups, and expert interviews to generate reliable market estimates.

Consumer behavior analysis forms another critical component. African consumers exhibit distinct purchasing patterns influenced by cultural values, income volatility, informal economy participation, and rapidly changing technology adoption rates. Understanding these nuances requires local expertise and culturally sensitive research approaches. For instance, consumer loyalty drivers in Lagos may differ significantly from those in Nairobi or Accra, necessitating market-specific insights rather than continent-wide generalizations.

Competitive landscape assessment provides crucial intelligence about existing players, market share distribution, competitive advantages, and potential partnership or acquisition targets. In many African markets, competition includes a mix of international corporations, regional champions, and informal sector operators, each requiring different analytical approaches. Market research Africa services must account for both formal and informal competitive dynamics to provide a complete picture.

Distribution channel analysis is particularly crucial in African markets where traditional retail, informal markets, direct sales networks, and emerging e-commerce platforms coexist. Understanding how products reach consumers—and the margin structures at each distribution tier—often determines market entry success or failure.

The Strategic Importance of Market Research in Africa

Market research Africa initiatives serve as the foundation for risk mitigation and opportunity maximization. In markets characterized by information asymmetry, political volatility, and rapid change, decisions made without robust research carry exponentially higher risks than in developed economies.

Strategic market research provides the data necessary to answer fundamental expansion questions: Is there genuine demand for your product or service? What price points will the market accept? Which distribution channels offer the best reach and economics? What regulatory requirements will affect operations? Who are your true competitors, and what advantages do they hold? How do cultural factors influence purchasing decisions?

Beyond these foundational questions, comprehensive market research Africa services identify hidden opportunities that may not be apparent to external observers. Nigeria’s informal economy, for example, represents an estimated 65% of GDP—a massive market often overlooked by businesses focused solely on formal sector statistics. Professional market analysis services uncover these opportunities and develop strategies to address them.

Market research also enables businesses to anticipate and navigate risks specific to African expansion. Currency volatility, regulatory changes, infrastructure challenges, and supply chain complexities require proactive planning based on detailed market intelligence. Companies that invest in thorough market analysis services significantly reduce their risk exposure while positioning themselves to capitalize on market dynamics.

The return on investment for quality market research becomes evident when comparing success rates of well-researched market entries versus opportunistic expansions. Research-backed entries typically achieve break-even faster, scale more efficiently, and demonstrate greater resilience during market disruptions. In African markets where mistakes prove costly and time-consuming to correct, upfront investment in market analysis service Nigeria and broader African research pays substantial dividends.

Key Components of Comprehensive Market Analysis Services

Effective market analysis services for African expansion encompass multiple research dimensions that collectively provide a 360-degree view of market opportunities and challenges. Each component addresses specific information needs while contributing to an integrated understanding of the target market.

Market Sizing and Forecasting begins with establishing the total addressable market (TAM), serviceable addressable market (SAM), and serviceable obtainable market (SOM) for your specific offering. In African markets, this requires creative research methodologies combining demographic data, consumption patterns, income distribution analysis, and sector-specific indicators. Advanced forecasting models account for factors like population growth, urbanization trends, middle-class expansion, and technological adoption rates.

Regulatory and Legal Framework Analysis examines the legislative environment affecting your industry, including licensing requirements, foreign investment restrictions, tax implications, labor regulations, and compliance obligations. Nigeria’s regulatory landscape, for instance, varies significantly across sectors, with financial services and telecommunications facing stricter oversight than many other industries. Understanding these requirements prevents costly delays and compliance failures.

Consumer Insights and Segmentation goes beyond demographic profiling to understand psychographic factors, cultural influences, purchasing motivations, brand perceptions, and decision-making processes. This component identifies your ideal customer segments and provides the insights necessary for effective product positioning, marketing communications, and customer experience design.

Competitive Intelligence provides detailed analysis of direct and indirect competitors, including their market positioning, pricing strategies, distribution networks, strengths, weaknesses, and likely responses to new market entrants. In African markets, this analysis must account for both formal competitors and informal alternatives that consumers might consider as substitutes.

Supply Chain and Distribution Assessment evaluates the infrastructure, logistics networks, warehousing facilities, and distribution partners available in your target market. This component identifies potential bottlenecks, cost drivers, and partnership opportunities essential for operational planning.

Economic and Political Risk Assessment analyzes macroeconomic indicators, political stability, currency risks, and potential scenarios that could affect business operations. This forward-looking analysis enables contingency planning and risk mitigation strategy development.

Industry-Specific Market Research Solutions in Nigeria

Different industries face unique market dynamics in Nigeria, requiring specialized research approaches tailored to sector-specific challenges and opportunities. Generic market analysis rarely provides the depth necessary for successful sector entry.

Financial Services and Fintech market research must address Nigeria’s rapidly evolving digital payment ecosystem, regulatory framework changes, financial inclusion initiatives, and consumer trust dynamics. With Nigeria’s Central Bank actively promoting cashless policies and digital innovation, understanding the competitive landscape requires analysis of traditional banks, mobile money operators, and emerging fintech startups. Consumer research in this sector focuses on trust factors, security perceptions, transaction behavior, and adoption barriers.

Agriculture and Agribusiness research addresses value chain dynamics from farm to consumer, including production capabilities, processing infrastructure, storage facilities, and distribution networks. Nigeria’s agricultural sector presents opportunities across crop production, livestock, aquaculture, and agro-processing. Market analysis service Nigeria in this sector must evaluate government policies, climate considerations, land access, and the role of smallholder farmers in supply chains.

Technology and Telecommunications research examines infrastructure availability, device penetration, connectivity patterns, and digital service adoption. Nigeria’s tech ecosystem has produced several unicorn startups, making it Africa’s leading technology hub. Market research in this space analyzes developer talent availability, venture capital access, regulatory technology frameworks, and consumer digital behavior.

Healthcare and Pharmaceuticals market analysis addresses the dual system of public and private healthcare provision, pharmaceutical distribution channels, health insurance penetration, and disease burden patterns. Research in this sector requires understanding of NAFDAC (National Agency for Food and Drug Administration and Control) regulations, import requirements, and the prevalence of both genuine and counterfeit products.

Consumer Goods and Retail research focuses on purchasing power distribution, retail channel evolution, consumer brand preferences, and the balance between imported and locally manufactured products. Nigeria’s consumer market exhibits strong preferences for certain categories while remaining price-sensitive in others. Understanding these nuances requires detailed market segmentation and consumer behavior analysis.

Energy and Infrastructure market research examines the power sector, renewable energy opportunities, real estate development, and construction industry dynamics. With Nigeria facing significant infrastructure deficits, this sector offers substantial opportunities for investors who understand the regulatory framework, financing mechanisms, and public-private partnership structures.

Overcoming Market Entry Challenges in African Markets

African market expansion presents distinct challenges that require specialized knowledge and strategic approaches. Companies that successfully navigate these challenges share common characteristics: they invest in thorough market research, partner with local experts, and maintain flexibility in their market entry strategies.

Information asymmetry represents one of the most significant challenges. Unlike developed markets with extensive published data, many African markets lack reliable statistics on market size, consumer behavior, and competitive dynamics. This information gap necessitates primary research methodologies and local data collection networks. Professional market analysis service Nigeria providers maintain these networks, enabling access to ground-truth information unavailable through secondary sources.

Regulatory complexity and inconsistency create uncertainty for market entrants. Regulations may differ between stated policy and actual enforcement, require navigation of multiple government agencies, and change with limited notice. Successful market entry requires not just understanding current regulations but anticipating potential changes and building relationships with regulatory authorities. Market research Africa services with regulatory expertise provide crucial guidance through these complexities.

Infrastructure limitations affect everything from product distribution to payment collection. Power supply inconsistencies, poor road networks, limited warehousing facilities, and cash-dominant payment systems require creative operational solutions. Market analysis must realistically assess these constraints and identify workarounds that successful competitors employ.

Cultural and linguistic diversity demands localized approaches rather than continental strategies. What works in English-speaking Nigeria may fail in Francophone Côte d’Ivoire or Lusophone Angola. Even within single countries, ethnic and regional differences influence consumer behavior, requiring segmented market approaches. Comprehensive market research identifies these variations and recommends appropriate localization strategies.

Currency volatility and financial infrastructure challenges affect pricing strategies, profit repatriation, and financial planning. Nigeria has experienced significant currency fluctuations, requiring businesses to develop pricing models that remain viable across exchange rate scenarios. Market analysis services help model these scenarios and develop mitigation strategies.

Talent acquisition and retention presents challenges as businesses compete for limited pools of qualified professionals. Understanding labor market dynamics, compensation expectations, and talent development requirements forms part of comprehensive market entry planning.

Consumer Behavior Analysis Across African Demographics

Understanding African consumer behavior requires moving beyond demographics to examine the psychological, cultural, and economic factors that drive purchasing decisions. Nigeria’s diverse population provides a microcosm of broader African consumer dynamics.

The Rising Middle Class represents a key target segment for many businesses. Nigeria’s middle class, estimated at 20-30% of the population, exhibits increasing purchasing power, brand consciousness, and aspiration for quality products and services. However, middle-class status in Nigeria differs from Western definitions, with income thresholds and consumption patterns adapted to local contexts. Market research must accurately define and size this segment while understanding its specific preferences and purchasing triggers.

Youth Demographics dominate African markets, with Nigeria’s median age around 18 years. This youth bulge creates massive markets for education, technology, entertainment, and aspirational products. Young Nigerian consumers demonstrate high digital savviness, social media engagement, and willingness to try new products. However, they also face unemployment challenges and income constraints that affect purchasing power. Market analysis service Nigeria must balance youth market potential against economic realities.

Digital Adoption Patterns show remarkable leapfrogging of traditional technologies. Many Nigerians never owned desktop computers but access the internet primarily through smartphones. Mobile money adoption surged despite limited banking infrastructure. Understanding these adoption patterns helps businesses design appropriate digital strategies. Consumer research examines device ownership, data consumption habits, digital payment adoption, social media usage, and e-commerce behavior.

Value and Price Sensitivity characterize many African consumers who make careful purchasing decisions influenced by income volatility and competing financial obligations. However, price sensitivity doesn’t mean unwillingness to pay for perceived value. Nigerian consumers often prioritize quality and durability over initial price when purchasing decisions involve significant investment. Market research must identify the price-value equilibrium for different consumer segments.

Trust and Brand Loyalty play outsized roles in markets where product quality varies widely and counterfeit goods proliferate. Once Nigerian consumers identify trustworthy brands, they often demonstrate strong loyalty and become brand advocates. Building this trust requires consistent quality, visible presence, and community engagement. Consumer insights research identifies trust-building factors specific to each industry and segment.

Informal Economy Participation affects purchasing patterns, with many consumers earning income through informal channels. This reality influences everything from payment preferences to purchasing timing and preferred transaction sizes. Market research that ignores informal economy dynamics misses crucial insights about consumer behavior and market opportunity.

Competitive Intelligence and Market Positioning Strategies

Effective competitive intelligence goes beyond identifying competitors to understanding their strategies, capabilities, and vulnerabilities. In African markets, this intelligence enables positioning strategies that differentiate your offering while addressing genuine market needs.

Competitor Mapping begins with comprehensive identification of all relevant players, including international corporations, regional companies, local champions, and informal sector operators. Each competitor type presents different challenges and opportunities. International players may have resource advantages but lack local market understanding. Local competitors possess market knowledge and relationships but may have limited capital or technology. Informal operators offer extreme price competition but often compromise on quality and consistency.

Market analysis service Nigeria should evaluate each competitor across multiple dimensions: market share, geographic presence, product range, pricing strategy, distribution channels, marketing approaches, customer service capabilities, and financial strength. This multidimensional analysis reveals competitive gaps and opportunities for differentiation.

Strategic Positioning requires identifying underserved market segments or unmet needs where your offering provides distinctive value. In Nigerian markets, successful positioning often involves one of several approaches:

Quality differentiation works when existing options compromise on quality or consistency. Many Nigerian consumers actively seek reliable, quality products and will pay premiums for trustworthy brands.

Accessibility innovation addresses distribution challenges or price barriers preventing market participation. Examples include sachetization strategies making products affordable in smaller quantities or distribution innovations reaching previously underserved areas.

Service excellence differentiates in markets where after-sales service, customer support, or user experience lag customer expectations. Companies providing superior service experiences often build strong competitive advantages.

Localization strategies adapt products, services, or business models to specifically address Nigerian consumer preferences, payment behaviors, or usage patterns. Successful localization demonstrates understanding and respect for local market dynamics.

Partnership and Collaboration Strategies often provide competitive advantages in African markets. Strategic partnerships might include distribution agreements with established players, technology collaborations, or joint ventures combining your capabilities with local market access. Competitive intelligence identifies potential partners while assessing their reliability, capabilities, and strategic fit.

Market Entry Timing significantly affects competitive dynamics. Early movers in emerging Nigerian market segments can establish category leadership and customer loyalty before competition intensifies. However, early entry carries higher risks and requires greater market education investment. Market research Africa services help evaluate optimal timing by assessing market readiness indicators, competitive landscape development, and your organization’s preparedness.

Regulatory and Business Environment Assessment in Nigeria

Nigeria’s regulatory environment significantly impacts business operations across all sectors. Comprehensive market analysis service Nigeria must include detailed regulatory assessment to prevent compliance failures and identify regulatory risks and opportunities.

Federal and State Regulatory Structures create complexity as businesses navigate multiple jurisdictions. While federal laws provide overarching frameworks, state governments exercise significant authority over business licensing, taxation, and operations within their territories. Understanding which regulations apply at federal versus state levels, and how enforcement varies across locations, requires specialized knowledge.

Sector-Specific Regulations vary dramatically across industries. Financial services face Central Bank of Nigeria oversight with stringent licensing and compliance requirements. Telecommunications companies deal with Nigerian Communications Commission regulations. Food and pharmaceutical companies navigate NAFDAC requirements. Oil and gas operations face Department of Petroleum Resources oversight. Each regulator maintains different processes, timelines, and enforcement approaches.

Business Registration and Licensing processes have improved through initiatives like the Corporate Affairs Commission’s online registration system. However, obtaining operational licenses still requires navigating multiple agencies with varying efficiency levels. Market research should map complete licensing requirements, realistic timelines, and costs for your specific business activities.

Foreign Investment Regulations govern foreign ownership percentages in certain sectors, capital repatriation rules, and expatriate quota requirements. Nigeria generally welcomes foreign investment but maintains restrictions in strategic sectors like telecommunications, broadcasting, and aviation. Understanding these restrictions and structuring investments appropriately prevents future complications.

Tax Framework includes corporate income tax, value-added tax, withholding taxes, and various levies. Multiple taxation challenges arise as different government levels impose taxes and levies. Professional market analysis includes tax modeling showing realistic tax burdens beyond statutory rates.

Labor and Employment Laws regulate hiring practices, termination procedures, minimum wages, pension contributions, and expatriate employment. Nigeria’s labor environment balances worker protections with business needs, but compliance requires attention to detail and proper documentation.

Intellectual Property Protection through patents, trademarks, and copyrights exists within Nigeria’s legal framework, though enforcement can be challenging. Market research should assess IP protection mechanisms relevant to your business and develop strategies for protecting proprietary information and technology.

Recent Regulatory Reforms have aimed at improving the business environment through initiatives like the Presidential Enabling Business Environment Council (PEBEC). Understanding these reforms and their implementation status helps businesses take advantage of improvements while recognizing where challenges persist.

Market Size and Growth Potential Evaluation

Accurate market sizing forms the foundation of investment decisions, resource allocation, and performance expectations for African expansion. However, determining market size in African economies requires sophisticated methodologies that account for data limitations and market complexities.

Top-Down Market Sizing begins with macroeconomic data—population, GDP, sector output—and applies relevant assumptions to estimate your specific market. For example, estimating the market for premium beverages might start with urban population figures, apply middle-class percentage estimates, assign consumption frequency assumptions, and calculate resulting market size. While top-down approaches provide high-level estimates quickly, they may miss market nuances or informal sector dynamics.

Bottom-Up Market Sizing builds estimates from ground-level data—customer counts, average purchase values, consumption frequencies—scaling up to total market estimates. This approach often provides more accurate results for specific product categories but requires extensive primary research. Professional market analysis service Nigeria typically employs hybrid approaches combining top-down frameworks with bottom-up validation.

Market Segmentation refines size estimates by breaking markets into meaningful segments based on demographics, geography, psychographics, or behavior. Nigerian market segmentation might distinguish between urban and rural consumers, across income quintiles, by age cohorts, or through lifestyle segments. Each segment exhibits different market sizes, growth rates, and accessibility levels.

Growth Trajectory Analysis examines historical trends and future drivers to forecast market evolution. Nigeria’s market growth drivers include population increase, urbanization, middle-class expansion, technology adoption, and sector-specific developments. Comprehensive analysis models different growth scenarios—conservative, moderate, and optimistic—providing decision-makers with range estimates rather than single-point forecasts.

Addressable Market Assessment translates total market size into realistic targets for your business. The serviceable addressable market (SAM) accounts for geographic focus, segment targeting, and channel accessibility. The serviceable obtainable market (SOM) factors in competition, market entry timing, resource constraints, and realistic market share expectations over specific timeframes.

Market Maturity and Development Stages vary across Nigerian sectors and consumer segments. Some markets are nascent with minimal existing supply, requiring market education and infrastructure development. Others are mature with established competitors, requiring differentiation and market share capture. Understanding maturity stages helps set appropriate expectations and strategies.

Regional Market Variations exist across Nigeria’s six geopolitical zones and major urban centers. Lagos, Abuja, Port Harcourt, Kano, and other major cities each present distinct market sizes and characteristics. Market research Africa services evaluate these geographic variations to prioritize market entry locations and tailor strategies appropriately.

Risk Assessment and Mitigation Strategies for African Expansion

Comprehensive risk assessment enables businesses to make informed decisions about African market entry while developing mitigation strategies for identified risks. Market analysis service Nigeria should include systematic risk evaluation across multiple dimensions.

Political and Regulatory Risks include government stability, policy continuity, regulatory changes, and corruption. Nigeria has maintained democratic governance since 1999, but policy shifts between administrations can affect business operations. Risk assessment examines political stability indicators, regulatory change likelihood, and potential policy scenarios. Mitigation strategies include government relations programs, regulatory compliance systems, and operational flexibility enabling adaptation to policy changes.

Economic and Currency Risks encompass exchange rate volatility, inflation, interest rates, and macroeconomic shocks. Nigeria has experienced significant currency fluctuations and periodic economic challenges. Risk mitigation involves pricing strategies that account for currency movements, natural hedging through local sourcing, and financial instruments when available. Market research should model various economic scenarios and their implications for business performance.

Security Risks vary by region and affect operations, employee safety, and asset protection. While most Nigerian business centers maintain reasonable security environments, certain regions face elevated risks. Risk assessment evaluates security situations in target operating locations and develops appropriate security protocols, insurance coverage, and crisis response plans.

Operational Risks relate to infrastructure limitations, supply chain disruptions, and service provider reliability. Power supply inconsistency, for instance, affects most Nigerian businesses, requiring backup generators and associated costs. Market analysis identifies infrastructure constraints specific to your business requirements and evaluates mitigation options including alternative suppliers, redundant systems, and contingency planning.

Reputational Risks arise from brand mismanagement, quality failures, or cultural missteps in African markets where trust takes years to build but moments to destroy. Social media amplifies reputational challenges, making crisis response capabilities essential. Risk mitigation includes quality control systems, customer feedback mechanisms, and crisis communication planning.

Partnership and Counterparty Risks emerge when working with local distributors, joint venture partners, or service providers. Due diligence on potential partners, clear contractual arrangements, and ongoing monitoring help mitigate these risks. Market research Africa services often include partner evaluation and recommendation.

Intellectual Property Risks involve technology theft, counterfeiting, and unauthorized reproduction. While Nigeria has IP protection frameworks, enforcement can be challenging. Mitigation strategies include registered IP protection, operational security measures, and careful technology transfer planning.

Exit and Downside Scenarios deserve consideration despite optimistic entry plans. Understanding exit options, investment recovery mechanisms, and wind-down procedures provides insurance against worst-case scenarios. Market analysis should identify potential exit routes including asset sales, partnership restructuring, or market withdrawal strategies.

Data Collection Methodologies for Emerging African Markets

Collecting reliable market data in African markets requires creative methodologies that address infrastructure limitations, low internet penetration in certain segments, and varying literacy levels while maintaining research quality and representativeness.

Primary Research Approaches generate firsthand data directly from target markets. Face-to-face surveys remain highly effective in Nigerian markets, overcoming literacy barriers and building rapport that improves response quality. Mobile phone surveys leverage Nigeria’s high mobile penetration, reaching respondents cost-effectively across geographies. Online surveys target digitally-connected segments but recognize coverage limitations. Focus group discussions provide qualitative insights into consumer motivations, perceptions, and decision-making processes.

Secondary Research Sources include government statistics, industry association reports, academic research, and published market studies. However, African secondary data often suffers from limited availability, questionable accuracy, or outdated information. Professional market analysis service Nigeria validates secondary sources against primary research and local knowledge.

Observational Research involves direct observation of consumer behavior, retail environments, competitive activities, and market dynamics. This methodology proves particularly valuable for understanding informal markets, distribution channels, and consumption patterns difficult to capture through surveys.

Expert Interviews tap knowledge from industry insiders, government officials, trade association leaders, and market participants with specialized expertise. These interviews provide context, validate findings, and uncover insights unavailable through other methods.

Digital Data Sources increasingly provide market intelligence through social media analysis, e-commerce data, mobile money transactions, and digital platform activity. Nigeria’s high social media engagement creates rich data sources for sentiment analysis, brand perception tracking, and trend identification.

Hybrid Methodologies combine multiple approaches to triangulate findings and improve reliability. For example, market sizing might begin with secondary data, be refined through expert interviews, and validated through primary surveys in representative locations.

Sample Selection and Representativeness require careful attention to ensure research findings accurately reflect target markets. Probability sampling remains challenging in African markets without comprehensive sampling frames, necessitating quota sampling or stratified approaches that ensure demographic, geographic, and socioeconomic representation.

Quality Control Measures maintain research integrity through interviewer training, pilot testing, data validation checks, and verification procedures. Professional market research Africa providers implement rigorous quality protocols essential for reliable results.

Ethical Considerations guide research practices, including informed consent, data privacy protection, and cultural sensitivity. These ethical standards build trust with research participants while ensuring regulatory compliance with data protection requirements.

Sector-Specific Opportunities in Nigeria’s Growing Economy

Nigeria’s economic diversification creates opportunities across multiple sectors for businesses conducting proper market analysis and developing targeted entry strategies.

Technology and Digital Services represent exceptional growth opportunities as Nigeria leads African technology innovation. The fintech sector has attracted billions in investment, revolutionizing payments, lending, and financial inclusion. E-commerce platforms are scaling despite logistics challenges, serving increasingly online-savvy consumers. Software development, IT services, and digital content creation all show strong potential. Market analysis service Nigeria in tech sectors examines adoption rates, competitive positioning, regulatory frameworks, and infrastructure readiness.

Agriculture and Agro-Processing offers transformation opportunities in Africa’s most populous nation, which also happens to be a major agricultural producer. Value addition through processing, cold chain development, modern farming techniques, and input supply all present investment cases. Government policy supports agricultural development through various initiatives. Market research evaluates specific agricultural value chains from production through processing to distribution, identifying optimal entry points.

Healthcare and Medical Services address massive unmet needs as Nigeria faces healthcare access, quality, and affordability challenges. Private healthcare delivery, pharmaceutical distribution, medical equipment supply, health insurance, and telemedicine all show growth potential. Detailed market analysis examines regulatory requirements, payer systems, distribution channels, and competitive landscapes specific to healthcare subsectors.

Education and EdTech tap into strong educational aspirations among Nigerian families despite system inadequacies. Private schools, vocational training, professional certification, and increasingly digital learning platforms serve millions seeking quality education. Market research explores segment-specific needs, willingness to pay, content preferences, and delivery channel effectiveness.

Infrastructure and Construction benefit from massive infrastructure deficits requiring investment in transportation, power, housing, and telecommunications infrastructure. Public-private partnerships, development finance, and direct investment all play roles in infrastructure development. Market analysis assesses project pipelines, procurement processes, financing structures, and partnership opportunities.

Consumer Goods and Retail serve Africa’s largest consumer market with evolving preferences. Fast-moving consumer goods, household products, personal care, and fashion all demonstrate robust demand. Modern retail formats slowly gain share from traditional markets. Market research Africa services examine distribution strategies, pricing optimization, brand positioning, and channel evolution.

Financial Services continue transforming through digital innovation, regulatory evolution, and financial inclusion initiatives. Beyond fintech, opportunities exist in asset management, insurance, microfinance, and investment banking. Comprehensive market analysis evaluates segment attractiveness, regulatory feasibility, and competitive dynamics across financial subsectors.

Entertainment and Media flourish as Nigeria’s creative industries gain global recognition. Nollywood film production, music, digital content creation, gaming, and sports all show commercial potential. Market research examines monetization models, distribution platforms, consumer preferences, and IP protection considerations.

How Novatia Consulting Delivers Actionable Market Intelligence

Novatia Consulting specializes in providing comprehensive market analysis service Nigeria and market research Africa solutions that transform data into actionable strategies for successful market entry and expansion.

Local Expertise and Global Standards define our approach. Our team combines deep Nigerian market knowledge with international research methodologies, ensuring culturally relevant insights delivered with professional rigor. We understand African market nuances because we work within these markets daily, maintaining research networks, industry relationships, and on-ground presence that external consultants cannot match.

Customized Research Design recognizes that every client faces unique market questions and information needs. We don’t apply cookie-cutter templates but design research specifically addressing your industry, target segments, business model, and decision requirements. Our engagement process begins with in-depth discussions to understand your strategic objectives, ensuring research delivers answers to your specific questions.

Comprehensive Service Portfolio covers the full spectrum of market analysis needs. We conduct market sizing and forecasting, competitive intelligence, consumer research, regulatory analysis, partner identification, supply chain assessment, and risk evaluation. Clients can engage us for focused studies addressing specific questions or comprehensive analyses supporting full market entry planning.

Primary Research Capabilities leverage extensive field research networks across Nigeria and broader African markets. We conduct surveys, focus groups, expert interviews, and observational research to generate reliable primary data. Our quality control systems ensure data integrity while our analytical capabilities transform raw data into meaningful insights.

Industry Specialization spans multiple sectors including technology, financial services, agriculture, healthcare, consumer goods, energy, and infrastructure. This sector expertise enables us to ask the right questions, identify relevant benchmarks, and provide context that generic researchers miss.

Strategic Advisory Services extend beyond research delivery to strategic recommendations and implementation support. We help clients interpret findings, develop market entry strategies, evaluate partnership opportunities, and plan operational approaches. Our engagement doesn’t end with report delivery but continues through implementation guidance ensuring research translates into business results.

Relationship-Based Approach emphasizes long-term client partnerships over transactional engagements. We invest in understanding your organization, industry, and strategic objectives, becoming trusted advisors who provide ongoing market intelligence as your African operations evolve.

Technology-Enabled Research employs modern data collection platforms, analytical tools, and visualization technologies that enhance research efficiency and insight quality. We combine technological capabilities with human expertise, recognizing that sophisticated analysis requires both data and contextual understanding.

Confidentiality and Ethics guide all our work. We maintain strict confidentiality for client information, implement ethical research practices, and protect intellectual property. Clients trust us with sensitive strategic information and competitive intelligence, confidence we honor through professional conduct.

Actionable Deliverables focus on insights you can implement rather than impressive but impractical reports. We present findings clearly, support recommendations with evidence, and provide implementation roadmaps. Our success measures include your market entry success, not just research completion.

Measuring ROI: Success Metrics for African Market Entry

Establishing clear success metrics enables objective evaluation of African market entry performance and ensures accountability throughout the expansion process. Market analysis service Nigeria should include metrics framework development aligned with your strategic objectives.

Financial Metrics provide quantitative performance measures including revenue achievement against projections, profitability timelines, customer acquisition costs, lifetime value ratios, and return on investment calculations. These metrics should account for African market realities including longer breakeven periods than developed markets but potentially higher long-term returns.

Market Penetration Metrics track your progress capturing target market share. Measurements include customer count growth, geographic expansion, distribution point achievement, and brand awareness development. These metrics help assess whether market entry is gaining traction at expected rates.

Operational Metrics evaluate execution quality through measures like supply chain efficiency, distribution effectiveness, customer service performance, quality standards achievement, and regulatory compliance. Strong operational metrics indicate sustainable business development rather than just initial sales success.

Strategic Milestone Achievement assesses progress against planned market entry phases. Milestones might include partnership formation, regulatory approvals obtained, infrastructure established, team recruitment completed, and distribution network developed. Timeline adherence indicates execution effectiveness.

Customer Metrics examine customer satisfaction, retention rates, repeat purchase behavior, referral generation, and net promoter scores. In African markets where word-of-mouth strongly influences adoption, customer satisfaction metrics predict sustainable growth.

Competitive Position Metrics track your market position relative to competitors through comparative market share, brand preference studies, and competitive win/loss analysis. These metrics indicate whether your positioning strategy resonates with target customers.

Learning and Adaptation Metrics recognize that African market entry involves continuous learning. Metrics might include speed of strategy adjustment, lessons captured and applied, and improvement rates in key performance areas. Organizations that learn and adapt quickly achieve better long-term results.

Risk Metrics monitor exposure to identified risks through indicators like currency exposure levels, single-partner dependency, regulatory compliance status, and security incident rates. Proactive risk monitoring enables timely mitigation actions.

Investment Efficiency Metrics evaluate resource deployment effectiveness through measures like investment per customer acquired, market entry cost per revenue dollar, and time to positive cash flow. These metrics help optimize resource allocation across market entry activities.

Comprehensive metrics frameworks balance short-term performance indicators with long-term strategic objectives, financial measures with operational realities, and quantitative data with qualitative assessments. Regular metrics review enables course corrections that improve market entry outcomes.

Conclusion: Turning African Market Intelligence into Competitive Advantage

Africa’s economic transformation presents historic opportunities for businesses willing to invest in proper market analysis and strategic planning. Nigeria’s position as the continent’s largest economy and most dynamic market makes it the logical gateway for African expansion, but success requires more than ambition—it demands rigorous market intelligence, cultural understanding, and strategic execution.

Professional market analysis service Nigeria and comprehensive market research Africa solutions transform uncertainty into informed strategy. By understanding market sizes, consumer behaviors, competitive dynamics, regulatory environments, and operational realities, businesses position themselves for successful market entry rather than costly trial-and-error approaches.

The investment in quality market research delivers returns throughout your African journey—from initial market selection through entry strategy development, operational planning, partnership identification, and ongoing market adaptation. Organizations that prioritize market intelligence consistently outperform those relying on assumptions or superficial analysis.

Novatia Consulting brings the local expertise, research capabilities, and strategic advisory services necessary for African market success. Our commitment to actionable intelligence, client partnership, and implementation support ensures that market research translates into business results. Whether you’re exploring initial market feasibility or planning full-scale expansion, our team provides the insights and guidance that turn African market potential into profitable reality.

The question facing businesses today is not whether Africa offers opportunities—the continent’s demographic and economic trajectories make growth inevitable. The question is whether your organization will capture these opportunities through strategic, research-informed market entry or watch competitors establish positions while you hesitate. Contact Novatia Consulting to begin your African market analysis journey and transform market intelligence into competitive advantage.

Frequently Asked Questions (FAQs)

1. Why should I choose Nigeria as my entry point for African market expansion?

Nigeria serves as Africa’s premier market entry gateway due to its position as the continent’s largest economy and most populous nation with over 220 million people. The country’s economic diversity, digital infrastructure, and strategic location within ECOWAS provide unparalleled access to broader African markets. Success in Nigeria’s complex and diverse market environment often translates to adaptability across other African countries. Additionally, Lagos serves as a continental business hub offering access to talent, services, and market intelligence unavailable in many other African locations.

2. How long does comprehensive market analysis for Nigerian market entry typically take?

The timeline for thorough market analysis service Nigeria varies based on research scope, industry complexity, and information availability. Focused market feasibility studies typically require 4-6 weeks, while comprehensive market entry analyses spanning multiple research dimensions usually take 8-12 weeks. Industries with complex regulatory environments or requiring extensive primary research may need longer timeframes. Novatia Consulting works with clients to balance thoroughness with decision-making timelines, providing preliminary findings during research phases when time-sensitive decisions are necessary.

3. What makes market research in Africa different from research in developed markets?

African market research faces unique challenges including limited secondary data availability, infrastructure constraints affecting data collection, higher informal economy participation, rapidly evolving consumer behaviors, and significant urban-rural divides. Research methodologies must adapt to lower internet penetration in certain segments, varying literacy levels, and cultural factors affecting response patterns. Additionally, African markets exhibit greater diversity within countries, requiring more granular segmentation approaches. Professional market research Africa services employ specialized methodologies addressing these complexities while maintaining research quality and reliability.

4. How much does professional market analysis service Nigeria typically cost?

Market analysis costs vary significantly based on research scope, methodology complexity, geographic coverage, and deliverable depth. Focused studies addressing specific market questions might range from $15,000-$35,000, while comprehensive market entry analyses spanning multiple research components typically range from $40,000-$100,000+. Custom research requirements, extensive primary data collection, or multi-country African research increase investment levels. However, this upfront investment typically represents a small fraction of market entry costs while significantly improving success probability and reducing costly mistakes. Novatia Consulting provides transparent pricing based on specific client needs and objectives.

5. What are the biggest risks associated with African market expansion?

Key risks include currency volatility affecting pricing and profitability, regulatory complexity and potential policy changes, infrastructure limitations impacting operations, political and security risks in certain regions, partnership and counterparty risks when working with local entities, reputational risks in trust-sensitive markets, and competitive intensity from both formal and informal players. Additionally, cultural misunderstandings, inadequate market research, and operational challenges represent common failure points. Comprehensive risk assessment and mitigation strategies form essential components of successful market entry planning. Professional market analysis identifies specific risks relevant to your industry and target markets while recommending appropriate mitigation approaches.

6. How do I identify reliable local partners for Nigerian market entry?

Identifying trustworthy local partners requires systematic evaluation processes including background checks, reference verification, financial stability assessment, capability evaluation, and cultural fit analysis. Look for partners with relevant industry experience, established distribution networks or market access, complementary capabilities, aligned strategic objectives, and demonstrated integrity. Due diligence should examine their reputation, financial health, legal compliance history, and existing business relationships. Market analysis service Nigeria providers like Novatia Consulting often include partner identification and evaluation as part of comprehensive market entry support, leveraging local networks and industry knowledge to recommend suitable partnership options.

7. What regulatory approvals are required for operating a business in Nigeria?

Regulatory requirements vary by industry but typically include business registration with the Corporate Affairs Commission, tax registration with the Federal Inland Revenue Service, obtaining sector-specific licenses from relevant regulatory bodies (e.g., Central Bank of Nigeria for financial services, NAFDAC for food and pharmaceuticals), expatriate quota approvals if employing foreign nationals, and various permits from state and local governments. The specific approval timeline and complexity depend on your business structure and operational activities. Comprehensive regulatory analysis as part of market research identifies all applicable requirements, realistic timelines, and potential challenges specific to your business, enabling proper planning and resource allocation.

8. How can I protect my intellectual property in Nigerian and African markets?

IP protection requires multi-layered approaches including formal registration of patents, trademarks, and copyrights with Nigeria’s IP office, contractual protections in partnership and employment agreements, operational security measures limiting technology access, careful technology transfer planning, and enforcement strategies when violations occur. While Nigeria’s IP legal framework exists, enforcement can be challenging, making preventive measures particularly important. Market research should assess IP risks specific to your technology or products and recommend protection strategies balancing legal registration with practical security measures. Consider also that brand building and customer loyalty create informal IP protection as consumers actively seek genuine products.

9. What is the typical timeline from market research to successful market operations in Nigeria?

Market entry timelines vary significantly based on industry, regulatory requirements, operational complexity, and resource availability. After completing market analysis (8-12 weeks), businesses typically need 3-6 months for entity establishment and regulatory approvals, 2-4 months for team recruitment and infrastructure setup, and 1-3 months for pilot operations before full launch. Total timeline from research initiation to operational status usually spans 12-24 months for most businesses, though simpler business models or favorable regulatory environments may enable faster entry. Complex industries like financial services or pharmaceuticals often require longer timelines due to licensing requirements. Comprehensive planning during the market analysis phase helps optimize timelines and identify critical path activities.

10. Does Novatia Consulting provide ongoing support after initial market analysis?

Yes, Novatia Consulting emphasizes long-term client partnerships extending beyond initial research delivery. We provide implementation support as you execute market entry strategies, ongoing market intelligence as conditions evolve, partnership facilitation and due diligence, regulatory navigation assistance, and strategic advisory services addressing operational challenges. Many clients engage us for continuous market monitoring, competitive intelligence updates, and strategic planning support as their African operations mature. Our relationship-based approach means we invest in understanding your business deeply and provide trusted advisory support throughout your African market journey. Whether you need periodic market updates or comprehensive ongoing support, we structure engagement models matching your specific needs and growth stages.