Industry lifecycle analysis in Nigeria provides investors with powerful insights for making profitable investment decisions. Understanding where different sectors stand in their development cycle helps identify the best time to invest in Nigerian industries. This comprehensive guide examines how smart investors use lifecycle analysis to maximize returns while minimizing risks.

Introduction to Industry Lifecycle Analysis in Nigeria

Industry lifecycle analysis in Nigeria reveals patterns that determine investment success across different economic sectors. Every industry follows predictable stages from emergence through maturity and eventual decline. Nigerian investors who understand these patterns can time their investments for maximum profitability.

The Nigerian economy presents unique opportunities as multiple industries experience rapid transformation. Technology sectors are emerging while traditional industries reach maturity stages. Meanwhile, some older sectors face decline as consumer preferences shift toward modern alternatives.

Smart investors use this framework to allocate capital strategically across different lifecycle stages. Young industries offer high growth potential but carry significant risks. Mature sectors provide steady returns with lower volatility. Understanding these tradeoffs helps build balanced investment portfolios.

Why Industry Lifecycle Analysis Matters for Investors

Industry lifecycle analysis helps investors avoid costly timing mistakes that destroy wealth. Many investors chase hot sectors without understanding their lifecycle position. This approach often leads to buying at peaks and selling during downturns.

Nigerian markets show clear lifecycle patterns that savvy investors can identify and profit from. The telecommunications sector exploded in the early 2000s before maturing into steady growth. Banking evolved from rapid expansion to consolidation and regulation. These patterns repeat across different industries.

Risk management improves dramatically when investors understand lifecycle dynamics. Growth-stage companies require different evaluation criteria than mature businesses. Declining industries need exit strategies rather than expansion plans. This knowledge prevents major investment losses.

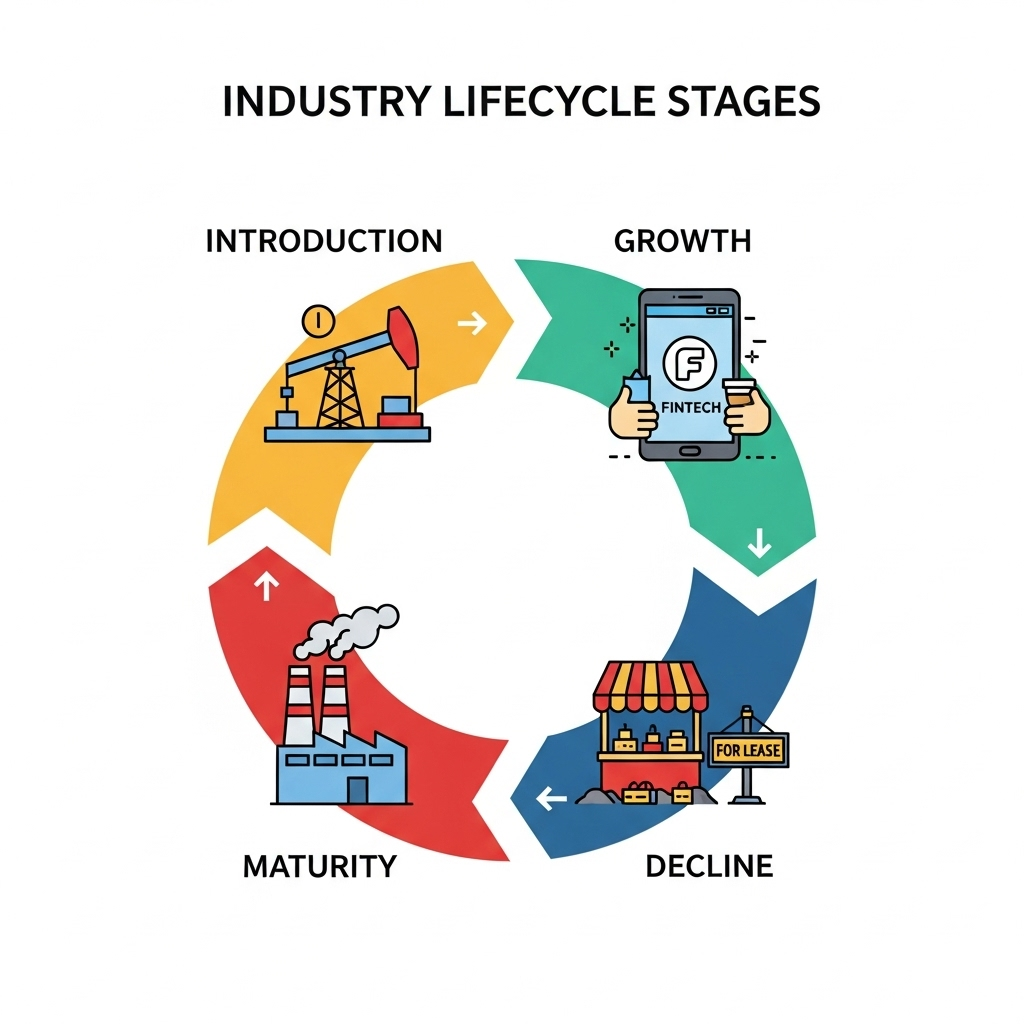

Key Stages of the Industry Lifecycle Explained

Industry lifecycle analysis identifies four distinct stages that determine investment strategies and expected returns. Each stage presents different opportunities and challenges for investors seeking profitable outcomes.

The emergence stage features high uncertainty but tremendous growth potential. Companies burn cash while building market awareness and infrastructure. Few players exist, creating opportunities for first movers. However, many startups fail during this risky phase.

Growth stages attract significant investment as market demand accelerates rapidly. Successful companies scale operations and capture market share. Competition intensifies as new players enter attractive markets. Investors can achieve excellent returns but must time entries carefully.

Maturity brings stable cash flows but slower growth rates. Market leaders establish dominant positions while weaker competitors struggle. Investment returns become more predictable but less spectacular. This stage suits investors seeking steady income rather than explosive growth.

How Industry Lifecycle Analysis Guides Investment Timing

Industry lifecycle analysis Nigeria provides systematic frameworks for determining optimal investment entry and exit points. Timing decisions based on lifecycle stages produce superior returns compared to random investment approaches.

Early-stage investments require patience and risk tolerance as companies develop their business models. Investors must evaluate management teams, market potential, and competitive advantages. Success stories like Jumia and Flutterwave show the rewards possible from well-timed early investments.

Growth-stage timing focuses on identifying companies poised for rapid expansion. Revenue acceleration, market share gains, and operational improvements signal attractive investment opportunities. However, valuations often become stretched during growth phases, requiring careful analysis.

Exit timing becomes crucial as industries approach maturity or decline. Smart investors reduce positions before growth slows significantly. Some sectors experience sudden disruptions that accelerate decline phases. Regular lifecycle monitoring prevents investors from holding positions too long.

Opportunities in Nigeria’s Emerging Industries

Industry lifecycle analysis Nigeria reveals several emerging sectors creating wealth for early investors. Fintech companies continue transforming financial services across Nigeria’s large unbanked population. Digital payment systems and mobile banking drive rapid adoption rates.

Renewable energy presents massive opportunities as Nigeria seeks alternatives to expensive fossil fuel imports. Solar power installations grow rapidly while government policies support clean energy development. Early investors in solar manufacturing and installation companies see strong returns.

E-commerce platforms benefit from growing internet penetration and smartphone adoption. Nigerian consumers increasingly shop online for convenience and variety. Logistics companies supporting e-commerce also experience rapid growth as delivery networks expand.

Healthcare technology addresses critical needs in Nigeria’s underserved medical sector. Telemedicine platforms and digital health records improve access to quality care. Pharmaceutical distribution networks optimize drug supply chains across the country.

Growth Stage Industries in Nigeria: Where to Invest Now

Industry lifecycle analysis Nigeria identifies several sectors currently experiencing rapid growth that attract smart investment capital. These industries moved beyond risky emergence phases while maintaining strong expansion momentum.

The insurance sector benefits from regulatory reforms and growing middle-class awareness. Penetration rates remain low compared to other African countries, creating significant upside potential. Technology adoption improves customer service while reducing operational costs for leading insurers.

Agricultural technology transforms Nigeria’s farming sector through modern techniques and equipment. Food processing companies gain market share as urbanization increases demand for packaged products. Cold chain logistics solve critical food preservation challenges while creating investment opportunities.

Entertainment and media industries grow as Nigerian content gains international recognition. Nollywood productions attract global audiences while music streaming platforms expand rapidly. Content creators and distribution platforms both benefit from this cultural export boom.

Real estate development responds to rapid urbanization and population growth. Commercial and residential construction accelerates in major cities like Lagos and Abuja. Property management companies serve growing demand for professional real estate services.

Maturity Stage Sectors and Sustainable Investment Returns

Industry lifecycle analysis Nigeria shows several mature sectors that provide steady investment returns with manageable risk levels. These established industries offer dividend income and capital preservation opportunities for conservative investors.

Banking represents Nigeria’s most mature financial sector with clear leaders and stable market shares. Major banks generate consistent profits through diverse revenue streams. Regulatory oversight ensures stability while technological improvements maintain competitiveness against fintech challengers.

Cement manufacturing reaches maturity as major infrastructure projects drive demand. Leading companies benefit from high barriers to entry and strong pricing power. However, growth rates slow as the construction boom moderates and competition intensifies.

Consumer goods companies serving Nigeria’s large domestic market provide defensive investment characteristics. Food and beverage producers maintain steady demand regardless of economic cycles. Brand loyalty and distribution advantages protect market leaders from competitive threats.

Telecommunications services achieve maturity after years of rapid subscriber growth. Major operators focus on revenue per user improvements rather than subscriber acquisition. Data services and value-added offerings drive incremental revenue growth while maintaining stable customer bases.

Declining Industries: Risks for Nigerian Investors

Industry lifecycle analysis Nigeria helps investors identify sectors facing structural decline that pose significant risks to portfolios. These industries experience shrinking demand due to technological disruption or changing consumer preferences.

Traditional banking faces pressure from fintech innovations that offer superior customer experiences. Mobile money platforms and digital lenders capture market share from established banks. Branch networks become costly burdens rather than competitive advantages in digital banking environments.

Print media continues declining as readers migrate to digital platforms. Newspaper circulation drops while advertising budgets shift to online channels. Magazine publishers struggle with subscription models as social media provides free content alternatives.

Fossil fuel dependency creates risks for petroleum-related businesses as renewable energy adoption accelerates. Fuel importation companies may face reduced demand as electric vehicles gain popularity. Gas station operators need transition strategies for changing automotive technologies.

Physical retail stores lose customers to e-commerce platforms offering better prices and convenience. Shopping mall developers face declining foot traffic and rising vacancy rates. Traditional retailers must invest heavily in digital transformation to remain competitive.

Tools and Methods for Industry Lifecycle Analysis in Nigeria

Industry lifecycle analysis Nigeria requires systematic approaches using multiple data sources and analytical frameworks. Professional investors combine quantitative metrics with qualitative assessments to determine lifecycle positions accurately.

Market size measurements track industry revenue growth rates over time. Rapid expansion indicates growth stages while slowing growth suggests approaching maturity. Revenue decline signals industry contraction requiring careful analysis of underlying causes.

Competition analysis reveals market dynamics at different lifecycle stages. Emerging industries show few competitors while growth stages attract new entrants. Mature markets feature established leaders with stable market shares. Declining industries experience consolidation as weak players exit.

Technology adoption rates indicate disruption potential across different sectors. Industries embracing digital transformation often restart growth cycles. Sectors resisting technological change may experience accelerated decline phases. Innovation investments signal management commitment to lifecycle extension.

Regulatory environment assessment identifies government policies affecting industry development. Supportive regulations accelerate growth while restrictive policies may trigger decline. Policy changes can shift lifecycle timing significantly, requiring continuous monitoring.

Role of Data and Market Research in Investment Timing

Industry lifecycle analysis depends on high-quality data and comprehensive market research for accurate timing decisions. Professional investors allocate significant resources to information gathering and analysis capabilities.

Primary research through customer surveys and industry interviews provides insights unavailable from public sources. Management meetings reveal strategic plans and competitive positioning. Supply chain discussions identify emerging trends before they become obvious to other investors.

Secondary research synthesizes published reports from government agencies, trade associations, and research firms. Economic statistics reveal macro trends affecting multiple industries. Financial statements show company performance relative to lifecycle expectations.

Real-time data monitoring identifies inflection points where lifecycle transitions occur. Social media sentiment analysis reveals changing consumer preferences. Website traffic patterns indicate shifting demand across different sectors.

Predictive analytics combine historical patterns with current indicators to forecast lifecycle timing. Machine learning algorithms identify subtle signals that human analysts might miss. However, local market knowledge remains crucial for interpreting analytical results accurately.

Case Studies: Successful Timing of Nigerian Investments

Industry lifecycle analysis demonstrates its value through documented investment successes that generated exceptional returns for well-timed decisions. These cases illustrate practical applications of lifecycle principles.

MTN Nigeria’s early entry into the telecommunications market exemplifies perfect timing for the best time to invest in Nigerian industries. The company entered during the emergence stage when few competitors existed. Strong execution during the growth phase created dominant market position and excellent investor returns.

Dangote Cement invested heavily during Nigeria’s infrastructure boom, timing expansion perfectly with industry growth stages and investment in Nigeria opportunities. The company built production capacity ahead of demand while competitors hesitated. This strategic timing created market leadership and sustainable competitive advantages.

Access Bank’s aggressive acquisition strategy during the banking sector’s consolidation phase shows excellent sector lifecycle analysis for Nigerian investors. The bank acquired weaker competitors at attractive prices while building scale advantages. Timing these moves during industry restructuring created significant shareholder value.

Interswitch pioneered electronic payments before the fintech boom, demonstrating superior investment timing strategies for Nigerian startups. Early market entry allowed the company to build infrastructure and partnerships. When mobile payments exploded, Interswitch was perfectly positioned to capture growth.

Challenges in Applying Industry Lifecycle Analysis Locally

Industry lifecycle analysis Nigeria faces unique challenges that require local expertise and cultural understanding. International frameworks may not translate directly to Nigerian market conditions without significant adaptations.

Data quality issues affect analytical accuracy as many Nigerian companies provide limited financial disclosure. Private companies share even less information, making comprehensive industry analysis difficult. Investors must use proxy indicators and primary research to fill information gaps.

Regulatory unpredictability can disrupt expected lifecycle patterns as government policies change rapidly. New regulations may accelerate industry decline or restart growth cycles. Political considerations often influence policy decisions more than economic logic.

Infrastructure limitations create different lifecycle dynamics compared to developed markets. Poor power supply affects manufacturing competitiveness while bad roads increase distribution costs. These factors may extend or compress normal lifecycle timelines unpredictably.

Cultural factors influence adoption rates for new products and services. Traditional preferences may slow technology acceptance while family business structures affect industry consolidation patterns. Successful analysis must incorporate these social dynamics.

How Novatia Consulting Supports Industry Lifecycle Analysis in Nigeria

Industry lifecycle analysis Nigeria requires specialized expertise that Novatia Consulting provides to investors and business leaders. Our local market knowledge combined with international analytical frameworks produces superior insights for investment timing decisions.

Our research team maintains comprehensive databases tracking Nigerian industries across all lifecycle stages. Regular surveys and interviews with industry participants provide real-time insights. This primary research supplements public data sources with proprietary information.

Client advisory services help investors apply lifecycle analysis to specific investment decisions. We provide sector reports, company evaluations, and timing recommendations. Our track record includes successful guidance through multiple market cycles across different industries.

Training programs teach investment professionals how to analyze industry lifecycle for investment in Nigeria effectively. Workshops cover analytical techniques, data sources, and local market nuances. These educational services build internal capabilities while maintaining ongoing advisory relationships.

Custom research projects address specific client questions about market maturity and investment decisions Nigeria timing. Our team conducts detailed studies on emerging opportunities or declining sector risks. These focused analyses support major investment decisions with comprehensive data and analysis.

Future Trends Shaping Nigerian Industry Lifecycle Dynamics

Industry lifecycle analysis Nigeria must account for evolving trends that will reshape sectoral development patterns. Understanding these forces helps investors anticipate future opportunities and risks.

Digital transformation accelerates across all sectors as Nigerian businesses adopt modern technologies. Cloud computing, artificial intelligence, and automation change competitive dynamics. Traditional industries may experience renewed growth through technological upgrades.

Demographics drive demand shifts as Nigeria’s young population reaches peak earning years. Urban migration creates opportunities in housing, transportation, and services. Age structure changes affect healthcare, education, and entertainment consumption patterns.

Climate change impacts create new industries while threatening others. Renewable energy sectors will grow rapidly while fossil fuel dependence becomes risky. Agricultural adaptation technologies address changing weather patterns while creating investment opportunities.

Regional integration through African Continental Free Trade Area expands market opportunities. Nigerian companies can access larger customer bases while facing increased competition. Industry leaders may consolidate regional positions while smaller players struggle with expanded competition.

Smarter Investment Decisions with Lifecycle Insights

Industry lifecycle analysis Nigeria provides systematic frameworks for timing investment decisions and maximizing returns. Successful investors understand that different lifecycle stages require distinct strategies and risk tolerances.

The best time to invest in Nigerian industries varies by sector and individual company circumstances. Emerging industries offer growth potential but require patience and risk tolerance. Mature sectors provide stability but limited upside potential. Declining industries need careful exit planning.

Professional analysis prevents costly timing mistakes that destroy investor wealth. Understanding lifecycle dynamics helps identify inflection points where major changes occur. This knowledge creates competitive advantages for investors who act before trends become obvious.

Smart investors combine lifecycle analysis with other evaluation methods for comprehensive investment decisions. Financial analysis, management assessment, and competitive positioning remain important factors. However, lifecycle timing often determines whether these other factors produce positive returns.

Frequently Asked Questions

What is industry lifecycle analysis and how does it apply to Nigerian investments? Industry lifecycle analysis Nigeria examines how sectors evolve through emergence, growth, maturity, and decline stages to guide investment timing. This framework helps investors identify the best time to invest in Nigerian industries by understanding where each sector stands in its development cycle.

How can investors identify emerging industries in Nigeria for investment timing? Emerging industries show rapid technology adoption, government policy support, and growing consumer demand. Current examples include fintech, renewable energy, and healthcare technology sectors. These industries offer high growth potential but require careful risk assessment.

What are the best mature industries for stable returns in Nigeria? Banking, telecommunications, and consumer goods represent mature sectors offering steady dividends and capital preservation. These industries provide defensive characteristics during economic uncertainty while maintaining reasonable growth prospects.

How does market maturity affect investment decisions in Nigeria? Market maturity and investment decisions Nigeria require different approaches for each lifecycle stage. Mature markets offer predictable returns but limited growth, while emerging sectors provide expansion potential with higher volatility.

Can industry lifecycle analysis predict the best time to exit investments? Yes, lifecycle analysis identifies when industries approach maturity or decline phases, signaling optimal exit timing. Investors should reduce positions before growth slows significantly or disruption accelerates decline.

What challenges affect industry lifecycle analysis for Nigerian investors? Limited data availability, regulatory unpredictability, and infrastructure constraints create unique challenges. Local expertise becomes essential for accurate analysis and successful investment timing strategies for Nigerian startups.

How long do different lifecycle stages typically last in Nigerian industries? Lifecycle timing varies significantly by sector, but emergence phases often last 3-5 years, growth stages 5-10 years, and maturity periods can extend 15-20 years before decline begins.

Should investors focus on single lifecycle stages or diversify across stages? Diversification across lifecycle stages reduces portfolio risk while maintaining growth potential. Balanced portfolios typically include emerging opportunities, growth investments, and mature holdings for income generation.

What role does government policy play in Nigerian industry lifecycle dynamics? Government policies significantly influence lifecycle timing through regulations, incentives, and infrastructure investments. Policy changes can accelerate growth or trigger decline phases more rapidly than natural market forces.

How does Novatia Consulting help investors apply lifecycle analysis in Nigeria? Novatia Consulting provides specialized research, training, and advisory services for Nigerian market entry timing analysis. Our local expertise and proprietary data help investors make better-timed investment decisions across all lifecycle stages.