Securing investment for African projects requires more than just great ideas—it demands feasibility reports that speak directly to investor concerns while addressing the unique complexities of African markets. The difference between funded projects and those that languish in proposal stages often lies in how effectively feasibility reports communicate opportunity while honestly addressing challenges.

At Novatia Consulting, we’ve helped countless African entrepreneurs and multinational corporations structure feasibility reports that attract serious investment. Our approach combines international standards with deep local market insights, creating documents that resonate with both foreign investors and local stakeholders who understand Africa’s dynamic business environment.

Understanding the Purpose of a Feasibility Report for Investors in Africa

A feasibility report for investors in Africa serves as both a business case and a risk assessment tool, addressing the unique concerns that shape investment decisions in African markets. Unlike reports for developed markets, African feasibility reports must tackle perceptions about political stability, currency volatility, and infrastructure challenges while highlighting the continent’s tremendous growth potential. Smart investors know that Africa offers some of the world’s highest returns, but they need comprehensive analysis to understand how to capture these opportunities safely.

The primary purpose extends beyond simple project validation to include educating investors about local market dynamics they might not fully grasp. Many international investors lack deep knowledge of African business practices, regulatory environments, and cultural factors that influence project success. A well-structured feasibility report bridges this knowledge gap, providing context that helps investors make informed decisions while building confidence in project leadership’s market understanding.

African feasibility reports must also address the timeline and capital requirements unique to operating in developing markets. Projects in Africa often require longer development periods due to infrastructure constraints, regulatory processes, and stakeholder engagement requirements. Investors need realistic timelines and budget allocations that account for these factors rather than overly optimistic projections that set projects up for disappointment and funding shortfalls.

Key Components Investors Look for in African Project Feasibility Reports

Market size and growth potential rank among the most important elements investors examine when evaluating African opportunities. However, investors want more than just population statistics and GDP projections—they need detailed analysis of addressable markets, customer purchasing power, and competitive dynamics. The telecommunications boom across Africa succeeded because feasibility reports clearly demonstrated massive underserved populations with growing disposable income and limited existing infrastructure.

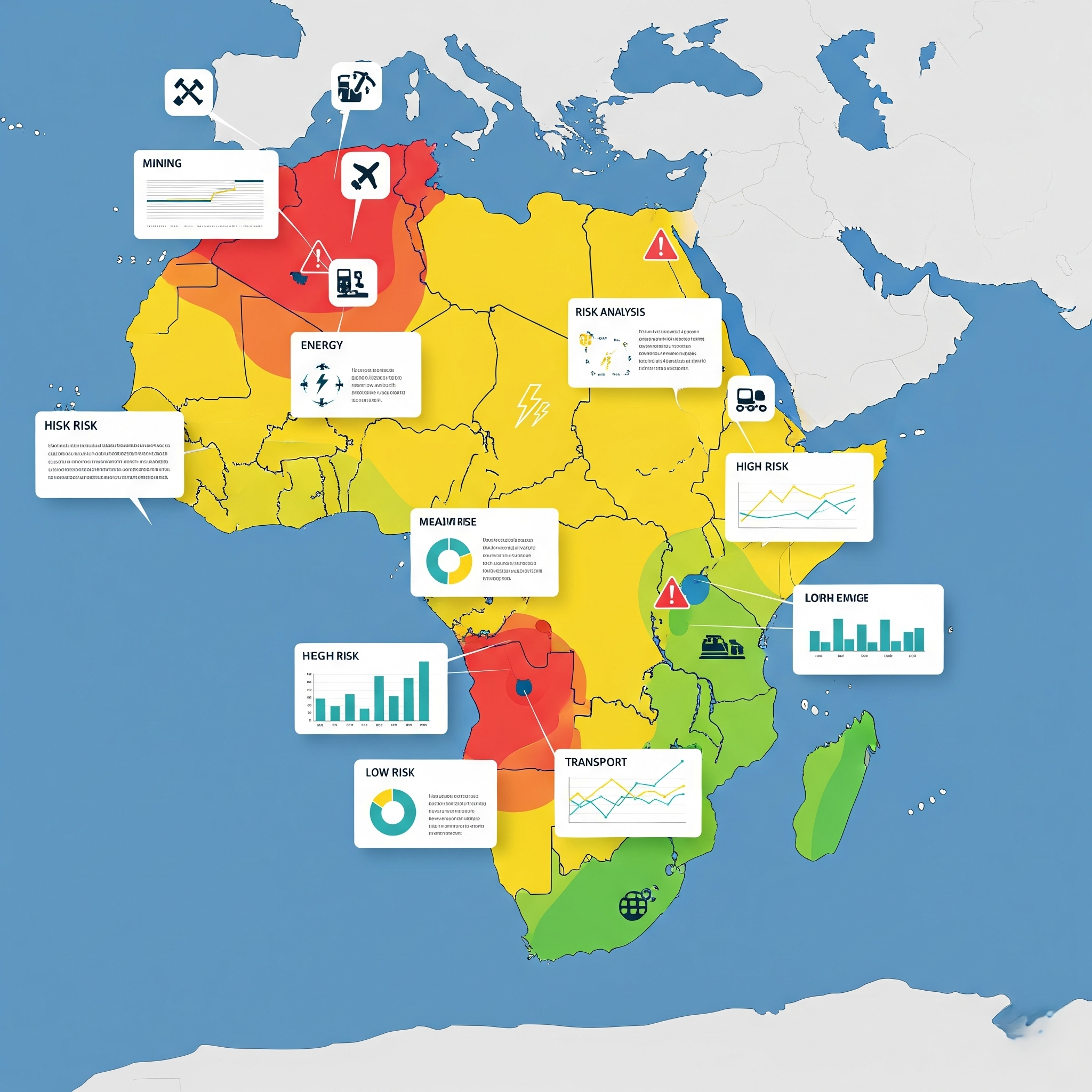

Risk assessment and mitigation strategies receive intense scrutiny from investors considering African projects. They want honest evaluation of political risks, currency exposure, regulatory uncertainty, and operational challenges, coupled with concrete plans for managing these risks. Successful feasibility reports don’t minimize risks; instead, they demonstrate comprehensive understanding of potential challenges and present credible strategies for addressing them through insurance, hedging, local partnerships, or operational design.

Financial projections must reflect African market realities rather than simply adapting models from developed markets. Investors expect sensitivity analysis that shows how projects perform under different scenarios, including currency devaluation, inflation spikes, and market entry delays. They also want clear exit strategies and timeline flexibility, recognizing that African projects might take longer to mature but can offer exceptional returns for patient capital.

How to Write a Feasibility Study for African Projects: A Step-by-Step Guide

Starting with comprehensive market research forms the foundation of any credible feasibility study for African projects. This means going beyond desktop research to include primary data collection through surveys, focus groups, and stakeholder interviews. Effective market research in Africa requires cultural sensitivity and local partnerships to access accurate information, particularly in rural areas where traditional research methods might not work effectively.

Technical feasibility analysis must account for Africa’s infrastructure constraints and opportunities. This includes assessing power availability, transportation networks, telecommunications connectivity, and skilled labor accessibility. However, smart feasibility studies also identify infrastructure development trends that might improve project conditions over time, such as planned road construction, power generation projects, or educational initiatives that could enhance the skilled labor pool.

Financial modeling should incorporate multiple scenarios that reflect Africa’s economic volatility while highlighting growth potential. This includes conservative, moderate, and optimistic projections based on different assumptions about market growth, competition, and operational efficiency. The modeling must also address funding requirements, including working capital needs that might be higher in African markets due to longer payment cycles and inventory requirements.

Novatia Consulting’s Approach to Structuring Investment Feasibility Reports

Our methodology begins with deep stakeholder engagement to understand investor priorities and risk tolerance levels. We recognize that different investor types—from development finance institutions to private equity funds to family offices—have varying requirements and expectations. This understanding shapes how we structure reports, what risks we emphasize, and how we present opportunities to align with specific investor mandates and return requirements.

We combine quantitative analysis with qualitative insights that capture the human elements often missing from traditional feasibility studies. This includes understanding customer behavior patterns, supplier relationship dynamics, and government stakeholder motivations that can significantly impact project success. Our team spends considerable time in project locations, building relationships and gathering insights that desktop analysis cannot provide.

Our reporting structure balances comprehensive analysis with accessibility, recognizing that busy investors need executive summaries that capture key points while detailed appendices provide supporting analysis. We use visual elements, infographics, and clear section organization that allows investors to quickly find information relevant to their specific concerns while providing depth for those who want detailed analysis.

Tailoring a Feasibility Report for Investors in Africa’s Emerging Markets

Different investor types require different report emphasis and structure to address their specific evaluation criteria and risk tolerance. Development finance institutions focus heavily on development impact, environmental sustainability, and social benefits, requiring feasibility reports that clearly articulate these outcomes alongside financial returns. Commercial investors prioritize return on investment and risk management, needing detailed financial projections and comprehensive risk mitigation strategies.

Geographic variations across Africa demand customized approaches that reflect specific country contexts and market conditions. A feasibility report for investors in Nigeria must address different regulatory frameworks, currency policies, and market dynamics than one targeting Kenya or Ghana. Effective reports acknowledge these differences and provide specific analysis relevant to target investment locations rather than treating Africa as a homogeneous market.

Sector-specific considerations also shape how feasibility reports should be structured and what information investors prioritize. Technology projects require different risk assessments than infrastructure developments, while agricultural value chain projects need analysis of seasonal variations and smallholder farmer dynamics. Understanding these sector-specific investor concerns allows feasibility reports to address the most critical success factors upfront.

Financial Projections and ROI in Investment Feasibility Study in Nigeria

Nigerian investment feasibility studies must address currency risk management strategies that protect returns from naira volatility. Smart projections model scenarios including different exchange rate assumptions and present hedging strategies that can stabilize returns for foreign investors. This includes analyzing the availability and cost of currency hedging instruments in Nigerian markets and alternative approaches such as natural hedging through local revenue generation.

Revenue projections should reflect Nigerian consumer behavior and purchasing power dynamics, particularly the growing middle class that drives consumption in sectors like retail, technology, and financial services. However, projections must also account for economic cycles, oil price impacts on the broader economy, and seasonal variations that affect different sectors. Realistic modeling helps build investor confidence by demonstrating thorough understanding of market dynamics.

Operating expense projections must account for Nigeria-specific cost factors including power generation costs, security expenses, and logistics challenges that might not exist in other markets. However, these higher operating costs should be balanced against Nigeria’s advantages such as large market size, skilled labor availability, and improving business environment. The key is presenting honest cost assessments while highlighting factors that support strong return potential.

Market Analysis Techniques That Strengthen Investor Confidence

Primary market research in African contexts requires methodologies adapted to local conditions and cultural practices. This might include mobile phone-based surveys in areas with limited internet access, community leader interviews to understand traditional decision-making processes, or partnering with local research organizations that have established trust and access in specific communities. Investors value market research that goes beyond standard approaches to capture authentic market insights.

Competitive analysis must account for both formal and informal sector competition that characterizes many African markets. This includes understanding how informal traders, traditional businesses, and emerging local competitors might affect market dynamics. Smart feasibility studies also analyze how international competitors might enter markets and what competitive advantages local projects might maintain through cultural understanding, relationship networks, or operational efficiency.

Customer segmentation analysis should reflect African market realities, including income distribution patterns, geographic accessibility constraints, and cultural preferences that influence purchasing decisions. This analysis helps investors understand addressable market size, pricing strategies, and distribution approaches that can effectively reach target customers. Effective segmentation also identifies early adopter segments that might drive initial growth before broader market penetration.

Addressing Regulatory Risks in Feasibility Reports for African Projects

Regulatory environment analysis must go beyond current laws to include regulatory trends and potential policy changes that could affect project viability. This requires understanding government development priorities, international pressure for regulatory reforms, and political dynamics that might influence policy direction. Investors need insights into how regulatory environments might change over project lifespans and how these changes could create risks or opportunities.

Compliance cost assessment should include direct regulatory costs such as licenses, permits, and ongoing compliance requirements, as well as indirect costs such as legal advisory services, government relations activities, and potential delays in approval processes. These costs can be significant in African markets but are often underestimated in feasibility studies, leading to budget shortfalls and investor disappointment.

Government relationship strategies form part of regulatory risk management and should be addressed in feasibility reports. This includes identifying key government stakeholders, understanding their interests and concerns, and developing engagement approaches that build support for projects while maintaining compliance with anti-corruption requirements and transparency standards that international investors expect.

Project Viability Assessment: What African Investors Want to See

Local investors often prioritize different success metrics than international investors, focusing on job creation, local capacity building, and community development impact alongside financial returns. African investors also tend to have longer investment horizons and higher risk tolerance for political and currency risks, but they may be more concerned about market competition and operational challenges that foreign investors might not fully appreciate.

Technical viability assessment must demonstrate that project teams understand local operating conditions and have realistic plans for managing infrastructure constraints, supply chain challenges, and human resource requirements. This includes showing how projects can adapt to power outages, transportation delays, and skilled labor shortages that characterize many African markets.

Scalability potential particularly interests African investors who understand that successful projects often grow rapidly once they prove viability in challenging environments. Feasibility reports should address how projects can expand geographically, add new products or services, or increase market penetration as conditions improve and operations mature.

How to Align Your Feasibility Report with Investor Expectations in Nigeria

Understanding Nigerian investment priorities requires recognizing the country’s focus on economic diversification, technology adoption, and youth employment creation. Investors want to see how projects contribute to these national objectives while generating attractive returns. Projects that align with government priorities often receive better regulatory support and may qualify for incentives or concessional financing.

Risk-return balance expectations in Nigeria reflect investors’ understanding of local market conditions and their experience with currency volatility, regulatory changes, and infrastructure challenges. Nigerian investors often accept higher risks in exchange for higher potential returns, but they expect comprehensive risk management strategies and realistic timelines that account for local operating conditions.

Exit strategy preferences among Nigerian investors might favor strategic acquisitions, management buyouts, or public listings on local exchanges rather than international sales that could create currency exposure. Understanding these preferences helps structure feasibility reports that address how investors can realize returns while supporting continued local ownership and operation.

Common Mistakes in Writing a Feasibility Study for African Projects

Over-reliance on secondary data without sufficient primary research leads to feasibility studies that miss critical local market dynamics. Many projects fail because feasibility studies relied on outdated statistics, regional data that doesn’t reflect local conditions, or assumptions about customer behavior that prove incorrect when projects launch. African markets change rapidly, making current, location-specific primary research essential for accurate feasibility assessment.

Underestimating implementation timelines represents another frequent mistake that damages investor confidence when projects experience inevitable delays. African projects often take longer than initially projected due to regulatory approval processes, infrastructure challenges, and stakeholder engagement requirements that feasibility studies fail to adequately account for. Realistic timeline projections help set appropriate investor expectations and reduce funding pressure during development phases.

Inadequate risk assessment, particularly around currency exposure, political changes, and operational challenges, can make feasibility studies appear naive to experienced investors. African investors and international investors with Africa experience expect comprehensive risk analysis that demonstrates understanding of potential challenges and presents credible mitigation strategies rather than optimistic assumptions about stable operating conditions.

The Role of Comparative Market Research in Feasibility Study Development

Regional market comparisons help investors understand how similar projects have performed in comparable African markets and what factors contributed to their success or failure. This analysis provides context for projections and helps investors benchmark expected returns and risk levels against actual project outcomes in similar environments.

International benchmarking against projects in other developing markets can provide additional perspective on viability and performance expectations. However, this comparison must account for differences in regulatory environments, market structures, and cultural factors that might make direct comparisons misleading. The goal is providing context rather than making inappropriate extrapolations.

Competitive analysis within target markets helps investors understand market positioning and competitive dynamics that will affect project success. This includes both direct competitors and alternative solutions that customers might choose instead of project offerings. Understanding competitive forces helps develop realistic market share projections and pricing strategies.

Structuring Executive Summaries That Speak to African Investors

Executive summaries for African investors should lead with opportunity size and growth potential, highlighting the demographic trends, economic development, and infrastructure improvements that create favorable conditions for investment. African investors often have strong conviction about continental growth prospects but need specific analysis about how individual projects can capture these opportunities.

Risk mitigation strategies deserve prominent placement in executive summaries because risk management differentiates successful African projects from failed ones. Investors want immediate understanding of major risks and how project teams plan to address them, including specific partnerships, insurance products, operational strategies, or financial structures that reduce risk exposure.

Return projections and timelines should be clearly stated with scenario analysis that shows performance under different assumptions. African investors appreciate transparency about uncertainties and want to understand how different market conditions might affect returns rather than single-point projections that may prove unrealistic.

Case Study: Successful Investment Feasibility Study in Nigeria

The Andela software development training program demonstrates how effective feasibility studies can attract international investment for African projects addressing local talent development. The feasibility study clearly articulated Nigeria’s large pool of university graduates seeking technology skills, growing demand from international companies for software development services, and competitive advantages of English-speaking, technically capable Nigerian developers.

The study’s success stemmed from comprehensive primary research including employer interviews, graduate surveys, and analysis of global software development outsourcing trends. This research provided credible evidence for market demand while honestly addressing challenges such as power infrastructure requirements, internet connectivity needs, and competition from established outsourcing destinations like India and Eastern Europe.

Financial projections balanced optimistic growth potential with realistic timelines for building operational capacity and market reputation. The study presented multiple expansion scenarios and clearly identified key success metrics that investors could track to evaluate performance against projections. This transparency helped build investor confidence and provided clear benchmarks for measuring progress.

Why Novatia Consulting Is Trusted for Feasibility Reports in Africa

Our track record spans diverse sectors and countries across Africa, giving us deep understanding of regional variations and sector-specific success factors. We’ve supported successful funding rounds for technology startups, infrastructure projects, agricultural value chains, and manufacturing ventures, providing insights that come only from extensive hands-on experience with African market dynamics.

Our team combines international expertise with local market knowledge, ensuring feasibility reports meet global standards while accurately reflecting African market realities. We maintain partnerships with local research organizations, government relations specialists, and sector experts that provide access to information and insights that desktop research cannot capture.

Our commitment to honest, comprehensive analysis builds long-term relationships with both investors and project developers. We don’t sugarcoat challenges or inflate projections to make projects appear more attractive; instead, we provide realistic assessments that help investors make informed decisions and help project teams build successful businesses based on solid foundations rather than unrealistic expectations.

Frequently Asked Questions

What should a feasibility report for investors in Africa include that’s different from other markets?

African feasibility reports must address currency risk, infrastructure constraints, regulatory complexities, and cultural factors unique to African markets. They should also highlight growth opportunities and demographic advantages that make Africa attractive to investors.

How long does it take to prepare a comprehensive feasibility study for African projects?

A thorough feasibility study typically requires 3-6 months, including primary market research, stakeholder consultations, and financial modeling. Complex projects or those requiring extensive regulatory analysis may need additional time.

What are the most important financial metrics investors want to see in an investment feasibility study in Nigeria?

Nigerian investors focus on IRR, payback period, currency-adjusted returns, and sensitivity analysis showing performance under different naira exchange rate scenarios. Cash flow projections and working capital requirements are also critical.

How should feasibility studies address political risks in African countries?

Studies should honestly assess political stability, policy consistency, and regulatory predictability while presenting specific mitigation strategies such as political risk insurance, local partnerships, or operational structures that reduce exposure.

What market research methods work best for African feasibility studies?

Effective research combines mobile surveys, community leader interviews, focus groups, and partnerships with local research organizations. Primary research is essential given limited reliable secondary data in many African markets.

Should feasibility reports focus more on opportunities or risks when targeting investors?

Balanced presentation works best—clearly articulate opportunities while honestly addressing risks and presenting credible mitigation strategies. Investors appreciate transparency and comprehensive analysis over overly optimistic projections.

How do you structure executive summaries for different types of African investors?

Development finance institutions want impact metrics upfront, while commercial investors prioritize returns and risk management. Local investors may focus on job creation and economic development alongside financial performance.

What role does cultural analysis play in African project feasibility studies?

Cultural factors affect customer behavior, employee management, supplier relationships, and community acceptance. Understanding cultural dynamics helps predict operational challenges and market acceptance patterns.

How detailed should regulatory analysis be in feasibility reports?

Analysis should cover current requirements, compliance costs, approval timelines, and potential policy changes. Include specific strategies for managing government relationships and maintaining regulatory compliance throughout operations.

What makes a feasibility study compelling enough to secure African investment?

Compelling studies combine realistic projections with clear opportunity articulation, demonstrate deep market understanding, present comprehensive risk management, and show strong local partnerships that enhance project viability.